State Taxation Standards

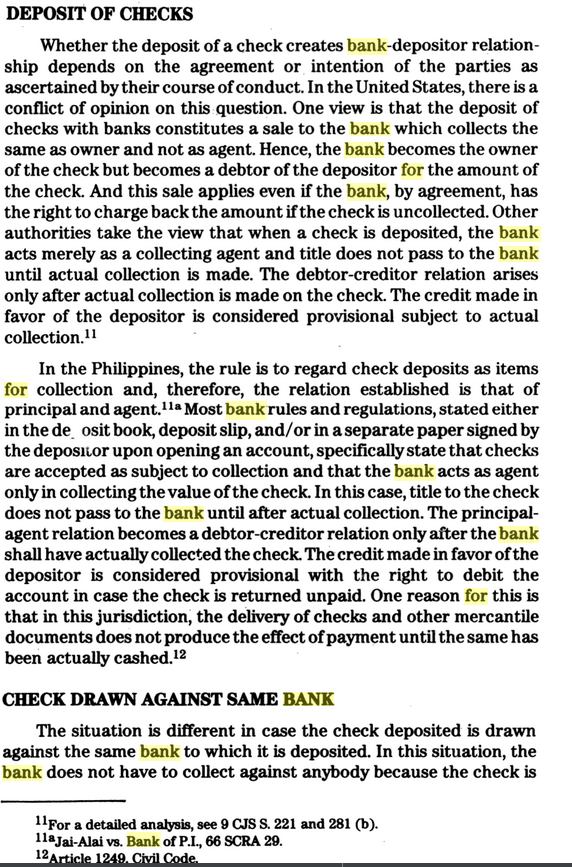

DEPOSIT OF CHECKS

Whether the deposit of a check creates bank-depositor relation- ship depends on the agreement or intention of the parties as ascertained by their course of conduct. In the United States, there is a conflict of opinion on this question. One view is that the deposit of checks with banks constitutes a sale to the bank which collects the same as owner and not as agent. Hence, the bank becomes the owner of the check but becomes a debtor of the depositor for the amount of the check. And this sale applies even if the bank, by agreement, has the right to charge back the amount if the check is uncollected. Other authorities take the view that when a check is deposited, the bank acts merely as a collecting agent and title does not pass to the bank until actual collection is made. The debtor-creditor relation arises only after actual collection is made on the check. The credit made in favor of the depositor is considered provisional subject to actual collection.11

In the Philippines, the rule is to regard check deposits as items for collection and, therefore, the relation established is that of principal and agent.11a Most bank rules and regulations, stated either in the de osit book, deposit slip, and/or in a separate paper signed by the depositor upon opening an account, specifically state that checks are accepted as subject to collection and that the bank acts as agent only in collecting the value of the check. In this case, title to the check does not pass to the bank until after actual collection. The principal- agent relation becomes a debtor-creditor relation only after the bank shall have actually collected the check. The credit made in favor of the depositor is considered provisional with the right to debit the account in case the check is returned unpaid. One reason for this is that in this jurisdiction, the delivery of checks and other mercantile documents does not produce the effect of payment until the same has been actually cashed.12

CHECK DRAWN AGAINST SAME BANK

The situation is different in case the check deposited is drawn against the same bank to which it is deposited. In this situation, the bank does not have to collect against anybody because the check is

11 For a detailed analysis, see 9 CJS S. 221 and 281 (b).

11a Jai-Alai vs. Bank of P.I., 66 SCRA 29.

12 Article 1249. Civil Code.

the accumulation of money for investment in economic endeavors, and, in the course of these activities, to obtain profit.

DELIVERY AND RECEIPT OF MONEY

A contract of bank deposit is a real contract which requires for its perfection the actual and physical delivery and receipt of the money by the bank.17 Consequently, added to the three basic elements of a contract, namely, consent, object and consideration, is the fourth element, the delivery of the money. Otherwise, the contract of bank deposit is not perfected. The usual method of making a deposit is for the depositor to hand the money within the bank premises during banking hours to a person ostensibly authorized by the bank to receive the same.

BANK PREMISES

The bank premises includes the main office, branches, sub- branches, agencies and extension offices. Branches, agencies and extension offices may be opened only upon prior approval of the Monetary Board.18 Before the amendments of the General Banking Act by Presidential Decree No. 71, government banks like the Philippine National Bank, Development Bank of the Philippines and the Philippine National Cooperative Bank, could open branches, agencies, extension offices, sub-offices, mobile banks or other offices even without the approval of the Monetary Board. 19 The law in force at present, however, covers even government banks which must seek approval of the Monetary Board for opening of branches, agencies, and office.20 A recent innovation in this area is the establishment of “money shops” and savings agencies in markets which are now authorized to receive deposits, service withdrawals and perform special banking services. Money shops were initially allowed to counteract the activities of usurers who prey on market vendors in dire need of capital. The opening and operation of money shops and savings agencies is presently regulated by the Central Bank.20a

17 Article 1913 in connection with Article 1934.

18Sec. 6-B General Banking Act, as amended, Manual of Regulation, Sections 1151,

2151 and 3151.

19CB Cir. No. 176 dated June 3, 1964.

20Sec. 6-B second par. General Banking Act, as amended by PD 71 and BP 61. 20aManual of Regulation. Secs, 1152, 2152, 3152 and 2153.

drawn against itself. Since the money representing the value of the check is already with the bank and there is no more collection to be made, the bank, in effect, pays the check, credits the amount to the depositor and again borrows the same sum from the depositor with the obligation to repay. Thus, the debtor-creditor relation is immedi- ately established unlike in the case of a check deposit drawn against another bank wherein the debtor-creditor relation is created only after collection.

DEPOSITS OTHER THAN MONEY

When the object deposited is something other than money, a different contract, not a contract of bank deposit, is drawn. Where stocks, bonds or other securities are deposited strictly for safekeep- ing, the agreement being to return the very same stocks, bonds or securities, the contract is of strict deposit.13 If there is an agreement allowing the use of but with the obligation to return stocks, bonds or securities of the same amount, type, series, quantity and/or quality, the contract involved is that of loan and not a bank deposit. 14 A bank does not normally accept deposit of goods and merchandise.

CONSIDERATION

The consideration or cause of a contract is the impelling reason for which a party enters into a contract. In onerous contracts, the consideration is understood to be, for each contracting party, the prestation or promise of a thing or service by the other.15 The consideration is different from the motive16 which is the personal and psychological reason for entering into the the contract. In so far as the depositor is concerned, the consideration for entering into the contract of bank deposit is the promise of the bank to repay the same amount deposited. For the bank the consideration is the privilege to use and invest the amount deposited. The motive of the depositor may vary from the stability and safety of the depository bank, the convenient location of the bank, the higher rate of interest paid, the superior service rendered by the bank as compared to others, or a combination of any or all of these motivations. The motive of banks in accepting deposits may be the desire to render public service, to aid in

13 Article 1962, Civil Code.

14 Article 1953-1955, Civil Code. 15 Article 1350, Civil Code. 16 Article 1351. Civil Code.

STATE TAXATION OF NATIONAL BANKS

THE UNDERSECRETARY OF THE TREASURY, Washington, September 6, 1927.

11

MY DEAR MR. MCFADDEN: I have your letter of August 28 with reference to the situation in California in so far as it relates to the taxation of national banks. You ask for an expression of opinion, and I am only too pleased to give you my views, though in doing so I am speaking as an individual and not in my official capacity.

In its more recent decisions, and more particularly in the Minnesota and Wisconsin decisions, the Supreme Court seems to have modified very consider- ably its interpretation of section 5219 of the Revised Statutes. In the Mercan- tile Bank case and in the subsequent cases in which the interpretation therein set forth was affirmed, there was a very definite tendency to limit the restric- tions in the statute to banking operations pure and simple; whereas in its more recent decisions the Supreme Court holds that individuals and corporations engaged in the business of making investments are competitors of national banks and that the investments made by them in the form of bonds, notes, and mortgages are “monied capital” as defined by the statute.. Under the decision in the Mercantile Bank case I believe that it would be possible for California to tax national banks under its present constitution, even though it exempts mortgages from taxation, but under the Minnesota and Wisconsin decisions, I agree with Messrs. Heron and Johnson that it is extremely doubtful whether California is in a position to-day to impose any tax on national banks, unless and until the Congress modifies section 5219. My own feeling is that Congress should do so. In fact, you will remember that when this question was before the House I felt very strongly that national banks would receive all of the pro- tection that they could justly ask for should Congress provide that national bank stock should not be taxed at a higher rate or in a different manner than the State imposed on State banks and trust companies or on corporations and individuals actually engaged in the banking business. My recollection is that after the Richmond decision I introduced an amendment to section 5219 along these lines. Everything that has happened since has confirmed the opinion which I then held. It is the duty of Congress to protect our national banking system from unfair and discriminatory legislation on the part of the States, but I have never felt, and I do not feel now, that National banks have any cause for complaint if they are taxed on precisely the same basis as State banks and trust companies.

I am returning herewith the inclosed papers. With best regards, very sincerely yours,

Hon. L. T. MCFADDEN,

OGDEN L. MILLS, Undersecretary of the Treasury.

House of Representatives, Washington, D. C.

[H. R. 8784, Sixty-seventh Congress, first session]

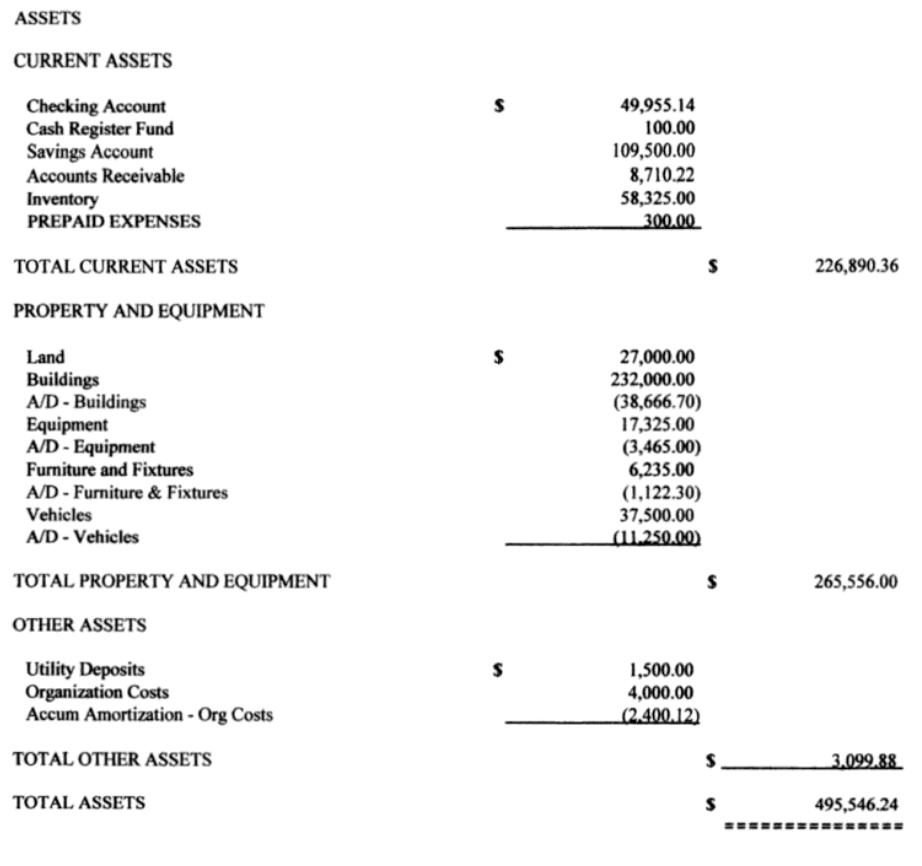

ASSETS

CURRENT ASSETS

Checking Account $ 49,955.14

Cash Register Fund

Savings Account

Accounts Receivable

Inventory

PREPAID EXPENSES

TOTAL CURRENT ASSETS

PROPERTY AND EQUIPMENT

Land

Buildings

A/D-Buildings

Equipment

A/D-Equipment

Furniture and Fixtures

A/D-Furniture & Fixtures

Vehicles

A/D – Vehicles

TOTAL PROPERTY AND EQUIPMENT

OTHER ASSETS 27,000.00

Utility Deposits$1,500.00

Organization Costs 4,000.00

Accum Amortization – Org Costs (2.400.12)

TOTAL OTHER ASSETS

TOTAL ASSETS

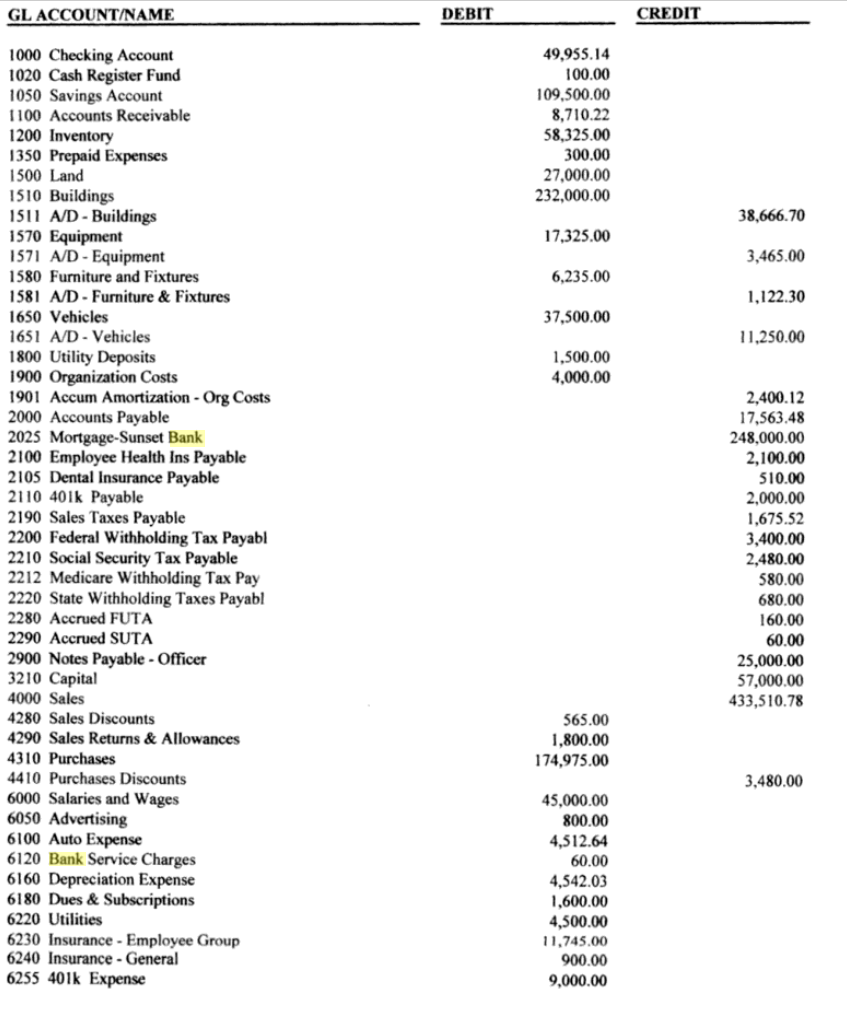

GL ACCOUNT/NAME

1000 Checking Account

1020 Cash Register Fund 1050 Savings Account

1100 Accounts Receivable

1200 Inventory

1350 Prepaid Expenses

1500 Land

1510 Buildings

1511 A/D-Buildings

1570 Equipment 17,325.00

1571 A/D-Equipment 3,465.00

1580 Furniture and Fixtures 6,235.00

1581 A/D-Furniture & Fixtures 1,122.30

1650 Vehicles 37,500.00

1651 A/D-Vehicles 11,250.00

1800 Utility Deposits 1,500.00

1900 Organization Costs 4,000.00

1901 Accum Amortization – Org Costs 2,400.12

2000 Accounts Payable 17,563.48

2025 Mortgage-Sunset Bank 248,000.00

2100 Employee Health Ins Payable 2,100.00

2105 Dental Insurance Payable 510.00

2110 401k Payable

2190 Sales Taxes Payable

2210 Social Security Tax Payable 2212 Medicare Withholding Tax Pay

2220 State Withholding Taxes Payabl

2280 Accrued FUTA

2200 Federal Withholding Tax Payabl

2290 Accrued SUTA 60.00

2900 Notes Payable – Officer 25,000.00

3210 Capital 57,000.00

4000 Sales 433,510.78

4280 Sales Discounts

4290 Sales Returns & Allowances 565.00 1,800.00

4310 Purchases 174,975.00

4410 Purchases Discounts 3,480.00

6000 Salaries and Wages

6050 Advertising

6100 Auto Expense 45,000.00 800.00 4,512.64

6120 Bank Service Charges 60.00

6160 Depreciation Expense 4,542.03

6180 Dues & Subscriptions 1,600.00

6220 Utilities 4,500.00

6230 Insurance – Employee Group 11,745.00

6240 Insurance – General

6255 401k Expense 900.00 9,000.00

—

The Trial Balance combines the Balance Sheet accounts with the Profit & Loss Statement accounts. The Balance Sheet accounts begin with Account 1000 Cash in Checking and end with Account 3210 Capital. Notice that the Retained Earnings account does not appear on the Trial Balance. That’s because the Retained Earnings amount for the first year a company operates is the same as the Net Profit or Loss for that year.

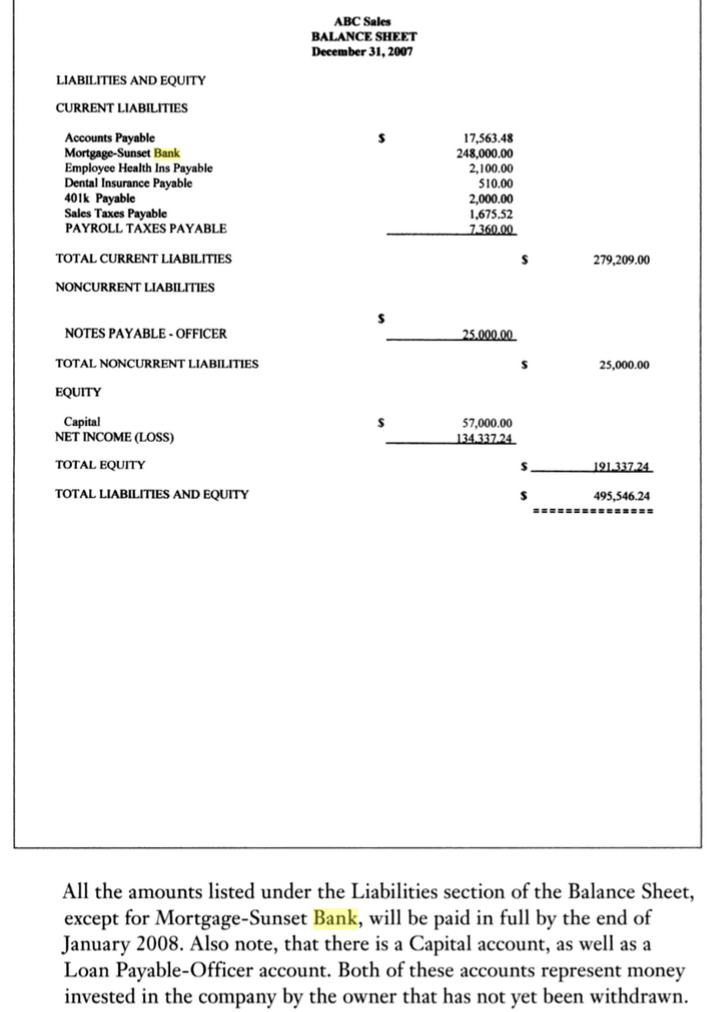

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Accounts Payable Mortgage-Sunset Bank

Employee Health Ins Payable

Dental Insurance Payable

ABC Sales BALANCE SHEET December 31, 2007

17,563.48 248,000.00

2,100.00

510.00

401k Payable

2,000.00

Sales Taxes Payable

1,675.52

PAYROLL TAXES PAYABLE

7.360.00

TOTAL CURRENT LIABILITIES

279,209.00

NONCURRENT LIABILITIES

NOTES PAYABLE – OFFICER

25.000.00

TOTAL NONCURRENT LIABILITIES

25,000.00

EQUITY

Capital

NET INCOME (LOSS)

TOTAL EQUITY

TOTAL LIABILITIES AND EQUITY

All the amounts listed under the Liabilities section of the Balance Sheet, except for Mortgage-Sunset Bank, will be paid in full by the end of January 2008. Also note, that there is a Capital account, as well as a Loan Payable-Officer account. Both of these accounts represent money invested in the company by the owner that has not yet been withdrawn.

Sales Income

Sales Discounts

Sales Returns & Allowances

Total Sales

433,510.78 (Credit)

565.00 (Debit)

1,800.00 (Debit)

431,145.78 (Credit)

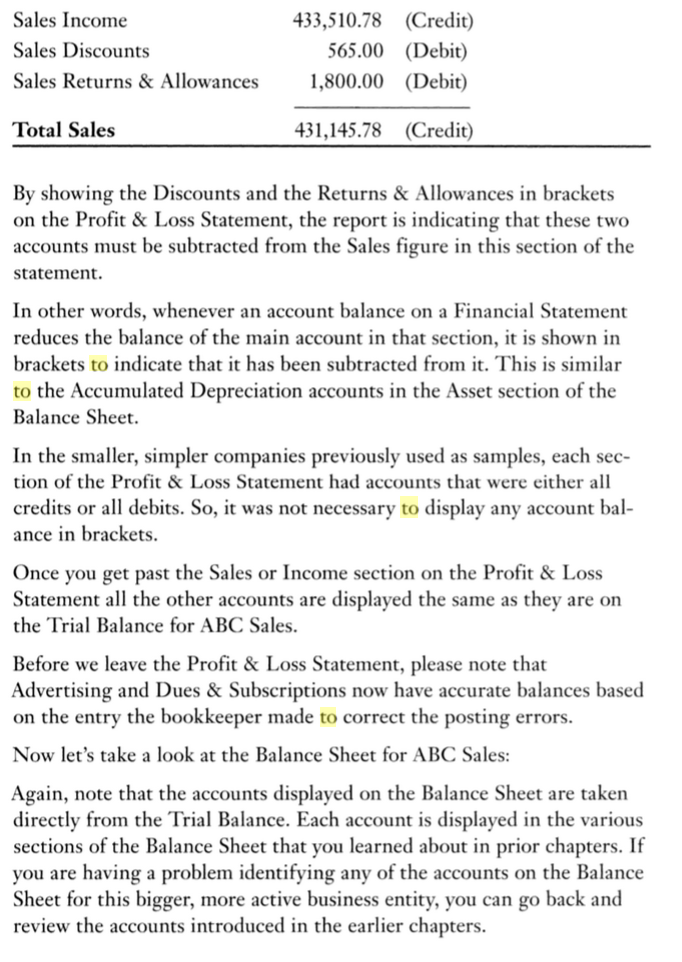

By showing the Discounts and the Returns & Allowances in brackets on the Profit & Loss Statement, the report is indicating that these two accounts must be subtracted from the Sales figure in this section of the

statement.

In other words, whenever an account balance on a Financial Statement reduces the balance of the main account in that section, it is shown in brackets to indicate that it has been subtracted from it. This is similar to the Accumulated Depreciation accounts in the Asset section of the Balance Sheet.

In the smaller, simpler companies previously used as samples, each sec- tion of the Profit & Loss Statement had accounts that were either all credits or all debits. So, it was not necessary to display any account bal- ance in brackets.

Once you get past the Sales or Income section on the Profit & Loss Statement all the other accounts are displayed the same as they are on the Trial Balance for ABC Sales.

Before we leave the Profit & Loss Statement, please note that Advertising and Dues & Subscriptions now have accurate balances based on the entry the bookkeeper made to correct the posting errors.

Now let’s take a look at the Balance Sheet for ABC Sales:

Again, note that the accounts displayed on the Balance Sheet are taken directly from the Trial Balance. Each account is displayed in the various sections of the Balance Sheet that you learned about in prior chapters. If you are having a problem identifying any of the accounts on the Balance Sheet for this bigger, more active business entity, you can go back and review the accounts introduced in the earlier chapters.